Multiple Choice

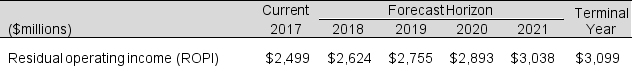

The following are forecasted residual operating income (ROPI) for Reed Corporation for 2017: Assume a discount rate of 6%, an expected terminal growth rate of 2% and 2017 NNO of $17,314. What is the firm's equity value using the ROPI valuation model?

Assume a discount rate of 6%, an expected terminal growth rate of 2% and 2017 NNO of $17,314. What is the firm's equity value using the ROPI valuation model?

A) $71,130

B) $53,816

C) $67,988

D) $17,314

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q65: Valuation models are typically based on payments

Q66: Following are financial statement numbers and select

Q67: Which of the following statements is true:<br>A)

Q68: Following is information from Intel Corporation for

Q69: Following are the income statements and

Q71: How do expectations about future profitability and

Q72: Heller Enterprises reports the following information. What

Q73: Two public companies (Jensen and Jackson) operate

Q74: A company can increase free cash flows

Q75: Following are financial statement numbers and select