Short Answer

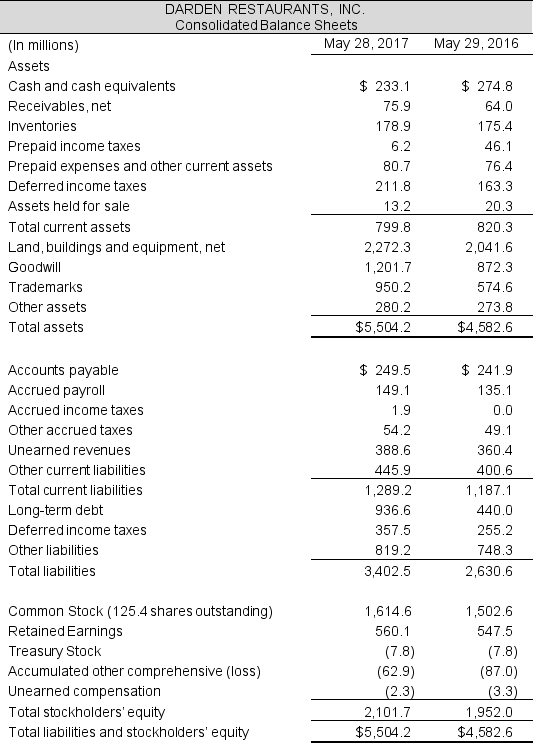

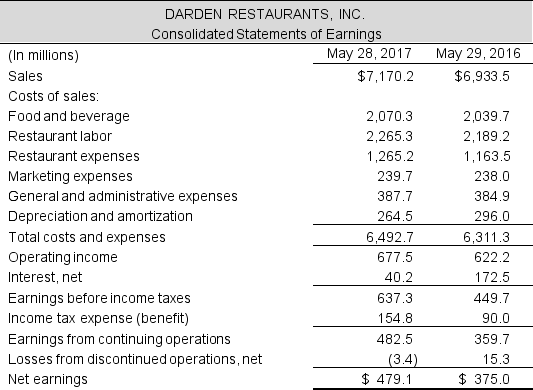

Following are the income statements and balance sheets for Darden Restaurants, Inc. for the fiscal year ending May 28, 2017.

Continued next page

Continued next page

Required:

Required:

a. Calculate the following metrics for 2017:

Net operating profit after tax (NOPAT)-assume the statutory tax rate is 37%

Net operating assets (NOA)

Net operating profit margin (NOPM)

Net operating asset turnover (NOAT)

Net nonoperating obligations (NNO)

b. Use the discounted free cash flow (DCF) model to estimate the per share value of Darden Restaurant's equity, at May 26, 2017. The company's weighted average cost of capital is 6%. Assume a sales growth rate of 5% for 2018-2021 with a terminal growth rate of 2%.

c. Darden Restaurant's shares closed at $85.83 per share on July 26, 2017, the date the 10-K was filed with the SEC. How does your valuation compare with this closing price?

Correct Answer:

Verified

a. NOPAT = $507.8: $677.5 - [$154.8 + ($...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q64: Following is the balance sheet for Goldsmith

Q65: Valuation models are typically based on payments

Q66: Following are financial statement numbers and select

Q67: Which of the following statements is true:<br>A)

Q68: Following is information from Intel Corporation for

Q70: The following are forecasted residual operating income

Q71: How do expectations about future profitability and

Q72: Heller Enterprises reports the following information. What

Q73: Two public companies (Jensen and Jackson) operate

Q74: A company can increase free cash flows