Short Answer

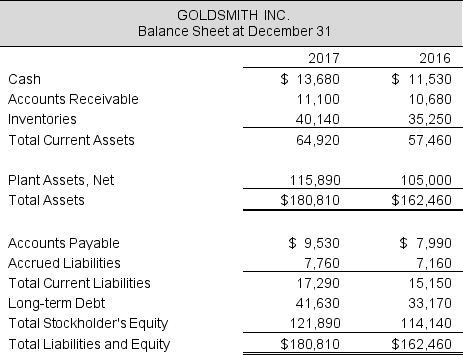

Following is the balance sheet for Goldsmith Inc.

The company has pretax interest expense of $2,214 and a statutory tax rate of 37%. Your online investigation reveals that the company has a beta of 0.9. Assume that the risk free rate in 2017 is 3.5% and an appropriate "spread" of equities over the risk-free rate is 5%.

The company has pretax interest expense of $2,214 and a statutory tax rate of 37%. Your online investigation reveals that the company has a beta of 0.9. Assume that the risk free rate in 2017 is 3.5% and an appropriate "spread" of equities over the risk-free rate is 5%.

Calculate the company's weighted average cost of capital.

Correct Answer:

Verified

WACC = (cost of debt × debt % capitaliza...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q59: The DCF valuation of a firm's equity

Q60: Which of the following items should not

Q61: Which of the following descriptions of Residual

Q62: McMahon Company manufactures SIM cards for cell

Q63: Following is information from Pinto Corporation for

Q65: Valuation models are typically based on payments

Q66: Following are financial statement numbers and select

Q67: Which of the following statements is true:<br>A)

Q68: Following is information from Intel Corporation for

Q69: Following are the income statements and