Short Answer

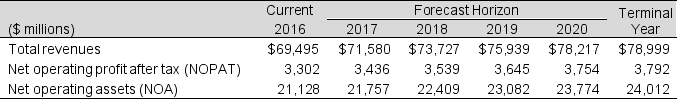

Following are financial statement numbers and select ratios for Target Corp. for the fiscal year 2016.

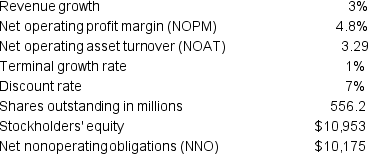

Forecast assumptions and other financial information for Target are as follows:

Forecast assumptions and other financial information for Target are as follows:

Required:

Required:

a. Use the discounted free cash flow (DCFF) model to estimate the value of Target's equity, per share at fiscal year-end 2016.

b. Target Corp. shares closed at $53.82 per share on March 8, 2017, the date the 10-K was filed with the SEC. How does your valuation compare with this closing price?

Correct Answer:

Verified

a.

*$3,554 / [0.07...

*$3,554 / [0.07...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q53: The weighted average cost is computed as:

Q54: The advantage of the dividend discount model

Q55: The Discounted Cash Flow model of valuation

Q56: A company wants to assess the performance

Q57: You have recently taken a position as

Q59: The DCF valuation of a firm's equity

Q60: Which of the following items should not

Q61: Which of the following descriptions of Residual

Q62: McMahon Company manufactures SIM cards for cell

Q63: Following is information from Pinto Corporation for