Short Answer

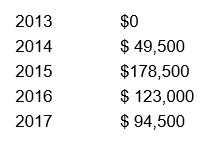

At the start of 2013, Shasta Corporation has 15,000 outstanding shares of preferred stock, each with a $60 par value and a cumulative 7% annual dividend. The company also has 28,000 shares of common stock outstanding with par value of $37.50 per share. At the beginning of 2017, the company has a 3-for-2 common stock split. The company pays total cash dividends as follows.

Calculate the dividends paid to each category of stockholders, in total and per share.

Calculate the dividends paid to each category of stockholders, in total and per share.

Correct Answer:

Verified

Dividend for preferred stock per year: ...

Dividend for preferred stock per year: ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: Kimberly-Clark recently repurchased 6.198 million shares of

Q22: Following is the stockholders' equity section of

Q23: On its 2017 balance sheet, Walgreens Boot

Q24: eBay's footnote regarding employee stock compensation details

Q25: A re-issuance of treasury stock at a

Q27: Convertible preferred stock conveys what additional benefit

Q28: During the year, Salem, Inc. had several

Q29: The following is an excerpt from the

Q30: In June 2017, Newcastle Inc. announced a

Q31: When there is a purchase and sale