Short Answer

The following is an excerpt from the 2017 statement of cash flows of Fey Company.

A footnote to the Fey Company financial statements included the following:

(a) Mandatory Convertible Preferred Stock

On March 13, 2017, Fey Company completed an offering of 1,245,000 shares of its 5.75% mandatory convertible preferred stock (the "Preferred Stock") at a public offering price of $582.40 per share, resulting in net proceeds of $714,212 million. At any time prior to March 14, 2020, holders of the Preferred Stock may elect to convert each share of Preferred Stock into 0.8680 shares of Common Stock, subject to anti-dilution adjustments.

Continued next page

Required:

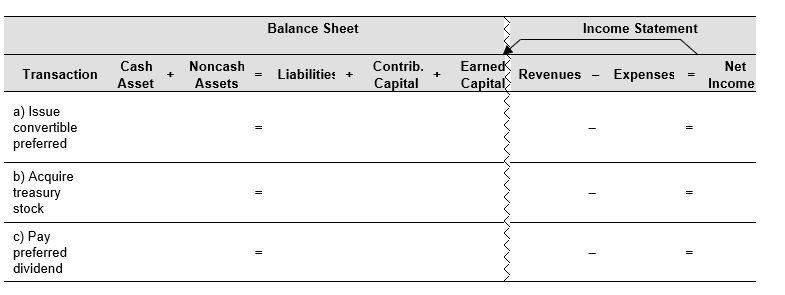

a. Use the financial statements effects template below to record the convertible preferred stock issued during 2017. The company reduced additional paid-in capital for the issuance costs paid to the underwriter.

b. Use the financial statements effects template below to record the treasury stock acquired.

c. Use the financial statements effects template below to record the dividend paid to preferred stockholders.

d. Assume that on January 1, 2018, all preferred shares are converted to $2.00 par common stock. Explain how Fey Company's balance sheet will be affected by this conversion. How would total equity change?

Correct Answer:

Verified

(in thousands)

* Sold 1,245,000 prefe...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

* Sold 1,245,000 prefe...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: eBay's footnote regarding employee stock compensation details

Q25: A re-issuance of treasury stock at a

Q26: At the start of 2013, Shasta Corporation

Q27: Convertible preferred stock conveys what additional benefit

Q28: During the year, Salem, Inc. had several

Q30: In June 2017, Newcastle Inc. announced a

Q31: When there is a purchase and sale

Q32: Mayhill Inc. reports 4,287,000 stock options granted

Q33: Redding Exports has the following stock outstanding:<br>25,000

Q34: Verizon Communications Inc. reported the following in