Short Answer

The 2016 income statement and balance sheet (excerpts) for BNSF Railway are below.

Continued next page

Continued next page

The footnotes to the financial statements included the following:

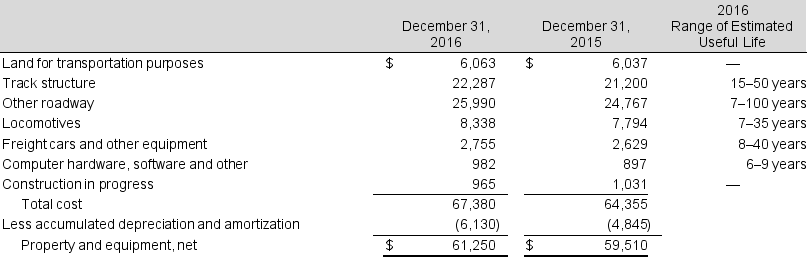

Property and equipment, net (in millions), and the corresponding ranges of estimated useful lives were as follows:

Required:

Required:

a. What proportion of total assets, does BNSF hold as property and equipment in 2016 and 2015? Does this surprise you?

b. Compute property and equipment turnover for 2016 and 2015. Property and equipment, net for 2014 was $55,806 million. Explain this ratio.

c. By what percentage are the assets 'used up' at year-end 2016? What implication does this ratio have for future cash flows at BNSF?

d. Estimate the useful life on average for the BNSF depreciable assets at year-end 2016. Which of the assets listed in the footnote explain this estimated useful life?

Correct Answer:

Verified

a. 2016: $61,250 / $84,122 = 72.8%

2015:...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

2015:...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Aiello Inc. had the following inventory in

Q2: The asset side of the 2017 balance

Q3: Assume that Barber Co. uses the LIFO

Q4: Note 3 to the 2016 financial statements

Q6: How do companies test assets for impairment?

Q7: Increasing inventory turnover rate will improve profitability.

Q8: The 2016 financial statements of CVS Health

Q9: Fey Enterprises recorded a restructuring charge of

Q10: The asset side of the 2016 balance

Q11: Employee severance costs, as part of board-approved