Short Answer

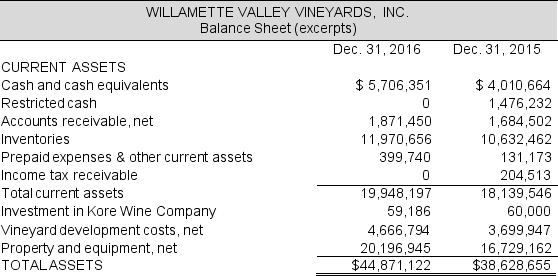

The asset side of the 2016 balance sheet for Willamette Valley Vineyards is as follows:

Continued next page

Continued next page

The following footnotes are from the annual report for Willamette Valley Vineyards for 2016.

Vineyard Development Costs

Vineyard development costs consist primarily of the costs of the vines and expenditures related to labor and materials to prepare the land and construct vine trellises. The costs are capitalized until the vineyard becomes commercially productive, at which time annual amortization is recognized using the straight-line method over the estimated economic useful life of the vineyard, which is estimated to be 30 years. Accumulated amortization of vineyard development costs aggregated $1,185,823 and $1,109,406 at December 31, 2016 and 2015, respectively.

Amortization of vineyard development costs are included in capitalized crop costs that in turn are included in inventory costs and ultimately become a component of cost of goods sold. For the years ending December 31, 2016 and 2015, approximately $76,417 and $75,669, respectively, was amortized into inventory costs.

Required:

Required:

a. Explain the difference between Vineyard development costs and Land and improvements.

b. Calculate the percent used up of the Vineyard development costs.

c. Calculate the percent used up of the Property and equipment. What does this imply for future cash flows for Willamette Valley Vineyards?

d. Assume that on January 1, 2017 the company determined that the Vineyard development costs had a fair value of $4,000,000. How would this affect the company's balance sheet and income statement in 2017?

Correct Answer:

Verified

a. The Vineyard development costs includ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: The 2016 income statement and balance sheet

Q6: How do companies test assets for impairment?

Q7: Increasing inventory turnover rate will improve profitability.

Q8: The 2016 financial statements of CVS Health

Q9: Fey Enterprises recorded a restructuring charge of

Q11: Employee severance costs, as part of board-approved

Q12: In order to estimate depreciation expense using

Q13: Firms typically report three categories of restructuring

Q14: Hauser Corporation has the following metrics for

Q15: Abercrombie & Fitch has inventory levels of