Short Answer

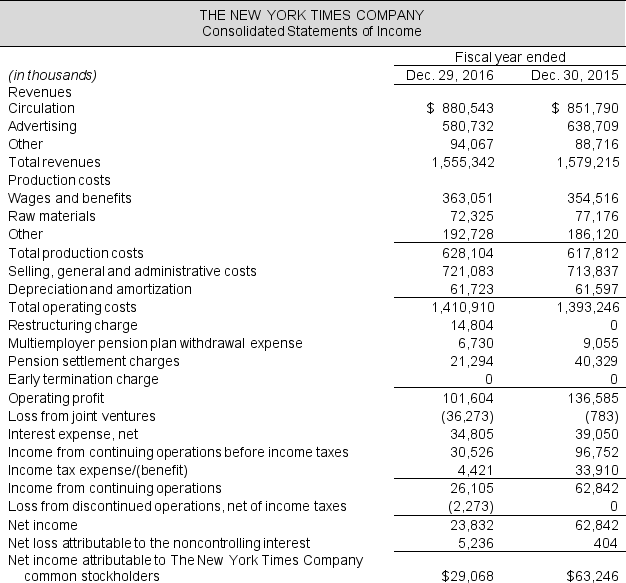

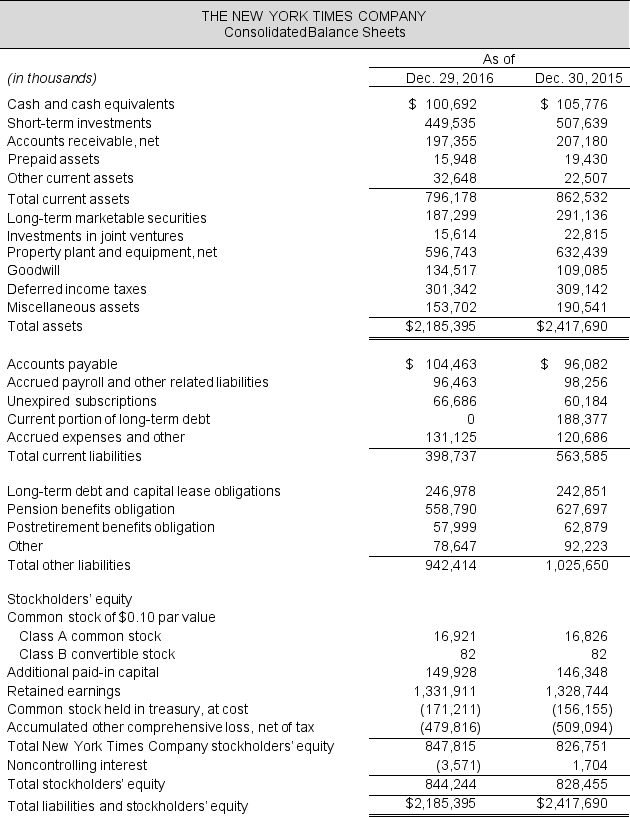

Income statements and balance sheets follow for The New York Times Company. Refer to these financial statements to answer the requirements.

Required:

a. Compute net operating profit after tax (NOPAT) for 2016 and 2015. Assume that combined federal and state statutory tax rates are 37% for both years.

b. Compute net operating assets (NOA) for 2016 and 2015.

c. Compute return on net operating assets (RNOA) for 2016 and 2015. Net operating assets are $397,299 thousand in 2014.

d. Compute return on common shareholders equity (ROE) for 2016 and 2015. Stockholders' equity attributable to New York Times Company in 2014 is $726,328 thousand.

e. What is nonoperating return component of ROE for 2016 and 2015?

f. Comment on the difference between ROE and RNOA. What inference do you draw from this comparison?

Correct Answer:

Verified

c. 2016: $48,032 / [($353,696 + $355,1...

c. 2016: $48,032 / [($353,696 + $355,1...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q38: To determine tax on net operating profit,

Q39: Selected income statement data follow for Harley

Q40: Use the following selected balance sheet and

Q41: A current ratio greater than 1.0 is

Q42: The current ratio is used to assess:<br>A)

Q44: Selected balance sheet income statement data follow

Q45: Income statements and balance sheets follow for

Q46: The 2016 balance sheet of Microsoft Corp.

Q47: The fiscal 2016 balance sheet for Whole

Q48: The 2016 balance sheet of E.I. du