Short Answer

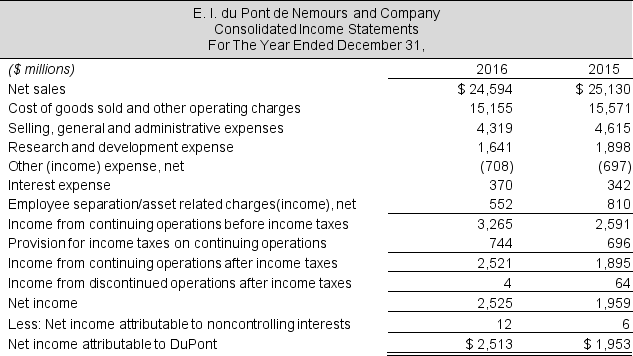

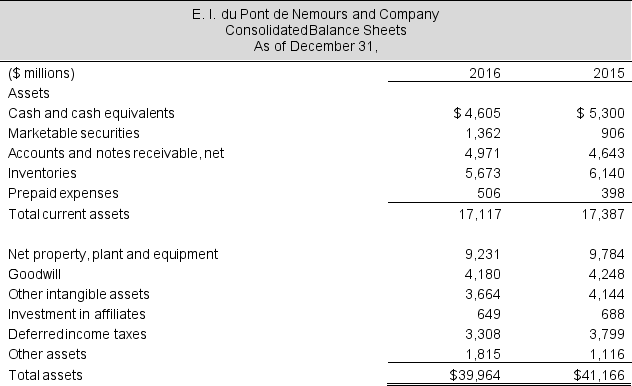

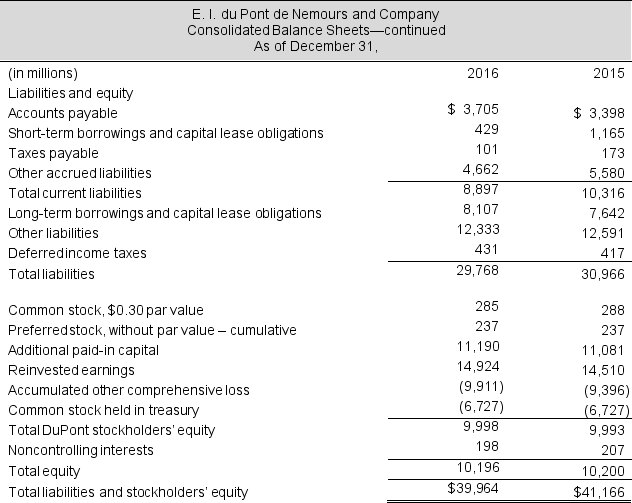

Income statements and balance sheets follow for E.I. DuPont de Nemours and Company. Refer to these financial statements to answer the requirements.

Required

Required

a. Compute net operating profit after tax (NOPAT) for 2016 and 2015. Assume that combined federal and state statutory tax rate is 37% for both years.

b. Compute net operating assets (NOA) for 2016 and 2015.

c. Compute return on net operating assets (RNOA) for 2016 and 2015. Net operating assets are $13,239 million in 2014.

d. Compute return on equity (ROE) for 2016 and 2015. DuPont Stockholders' equity in 2014 is $13,320 million.

e. What is nonoperating return component of ROE for 2016 and 2015?

f. Comment on the difference between ROE and RNOA. What inference do you draw from this comparison?

Correct Answer:

Verified

c. 2016: $2,308 / [($12,765 + $12,801)...

c. 2016: $2,308 / [($12,765 + $12,801)...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q40: Use the following selected balance sheet and

Q41: A current ratio greater than 1.0 is

Q42: The current ratio is used to assess:<br>A)

Q43: Income statements and balance sheets follow for

Q44: Selected balance sheet income statement data follow

Q46: The 2016 balance sheet of Microsoft Corp.

Q47: The fiscal 2016 balance sheet for Whole

Q48: The 2016 balance sheet of E.I. du

Q49: Income statements and balance sheets follow for

Q50: Explain the trade-off between net operating profit