Short Answer

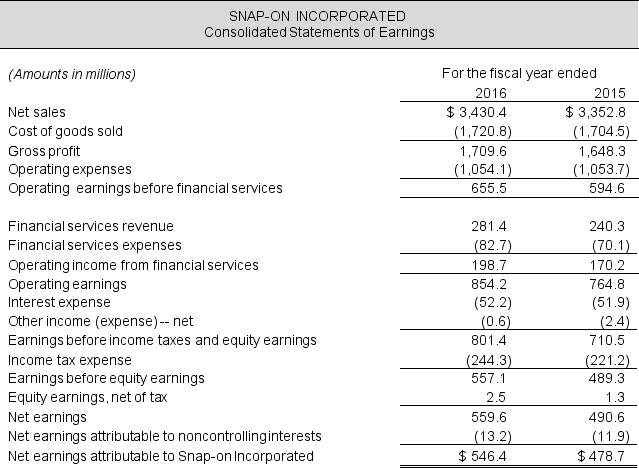

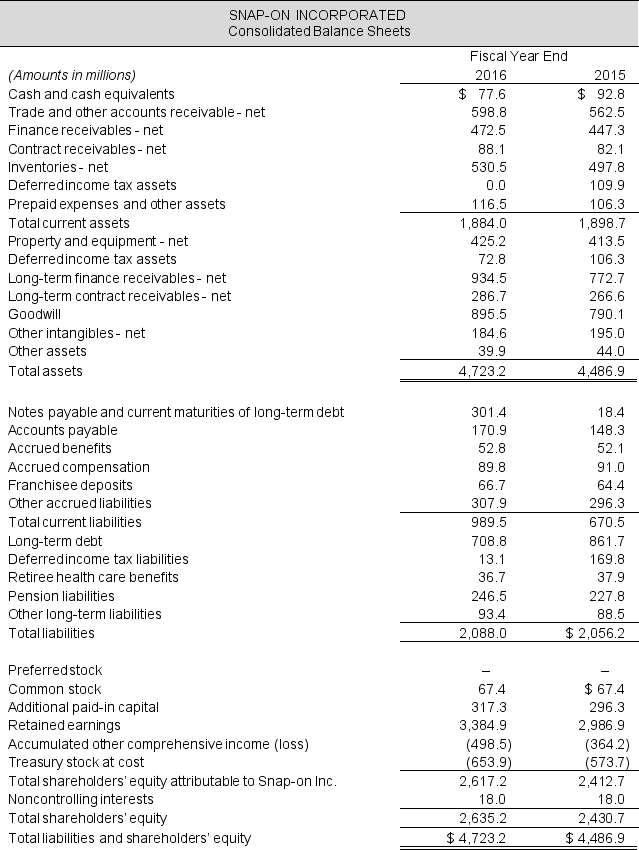

Income statements and balance sheets follow for Snap-On Incorporated. Refer to these financial statements to answer the requirements.

Required:

Required:

a. Compute net nonoperating expenses (NNE) for 2016 and 2015. Assume that combined federal and state statutory tax rate is 37% for both fiscal years.

b. Compute net nonoperating obligations (NNO) for 2016 and 2015.

c. Compute Spread for 2016 and 2015. Return on net operating assets is 17.5% and 16.8% in 2016 and 2015, respectively. In 2014, net nonoperating obligations were $786.4 million.

d. Compute FLEV for 2016 and 2015. In 2014, net nonoperating obligations were $786.4 million and total shareholders' equity was $2,225.3 million.

e. Calculate return on equity (ROE) for both years. Show that ROE = RNOA + (FLEV × Spread) x NCI ratio. Interpret the year-over-year change in ROE. (Hint: consider the changes in both FLEV and Spread.) In 2014, shareholders' equity attributable to Snap-On was $2,207.8 and total shareholders' equity was $2,225.3.

Correct Answer:

Verified

c. Spread = RNOA - (NNE / Average NNO)

c. Spread = RNOA - (NNE / Average NNO)

...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q44: Selected balance sheet income statement data follow

Q45: Income statements and balance sheets follow for

Q46: The 2016 balance sheet of Microsoft Corp.

Q47: The fiscal 2016 balance sheet for Whole

Q48: The 2016 balance sheet of E.I. du

Q50: Explain the trade-off between net operating profit

Q51: What is the difference between the traditional

Q52: Selected balance sheet and income statement data

Q53: Income statements and balance sheets follow for

Q54: Use Microsoft's balance sheets for the fiscal