Short Answer

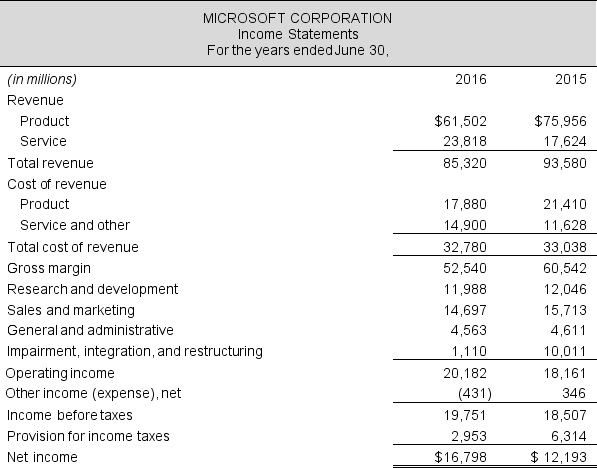

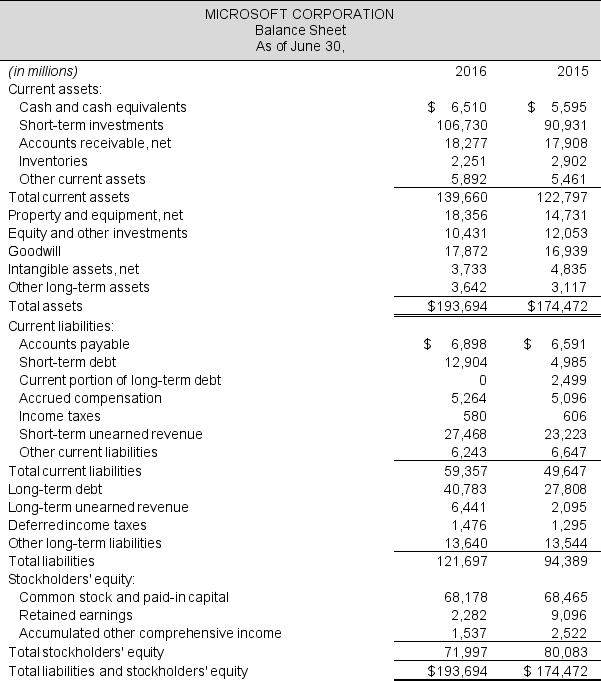

Income statements and balance sheets follow for Microsoft Corporation. Refer to these financial statements to answer the requirements.

Required:

Required:

a. Compute net nonoperating expenses (NNE) for 2016 and 2015. Assume that combined federal and state statutory tax rates are 37% for both years.

b. Compute net nonoperating obligations (NNO) for 2016 and 2015.

c. Compute Spread for 2016 and 2015. Return on net operating assets (RNOA) is 109.1% and 52.6% in 2016 and 2015, respectively. NNO were $(63,064) million in 2014.

d. Compute FLEV for 2016 and 2015. In 2014, net nonoperating obligations (assets) were $(63,064) million and shareholders' equity was $89,784 million.

e. Calculate return on equity (ROE) for both years. Show that ROE = RNOA + (FLEV × Spread). Interpret the year-over-year change in ROE.

Correct Answer:

Verified

c. Spread = RNOA - (NNE / Average NNO)...

c. Spread = RNOA - (NNE / Average NNO)...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: All else equal, when investors consider a

Q5: The 2016 financial statements of The New

Q6: The fiscal 2016 financial statements of Nike

Q7: Income statements and balance sheets follow for

Q8: Use the income statement for Microsoft Corporation

Q10: Use the following balance sheets and income

Q11: Selected balance sheet and income statement data

Q12: Use the following selected balance sheet and

Q13: Explain how return on net operating assets

Q14: Income statements and balance sheets follow for