Short Answer

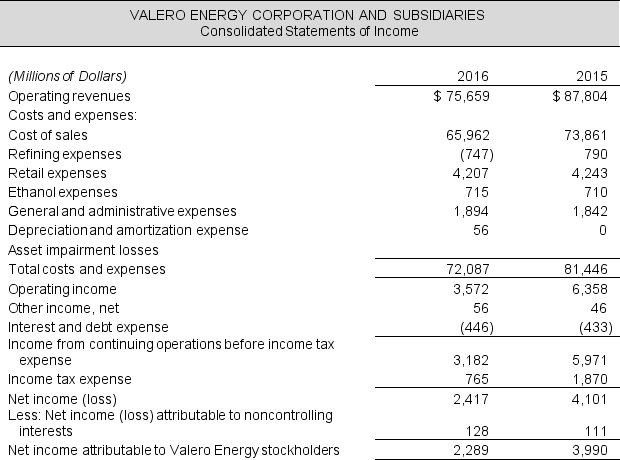

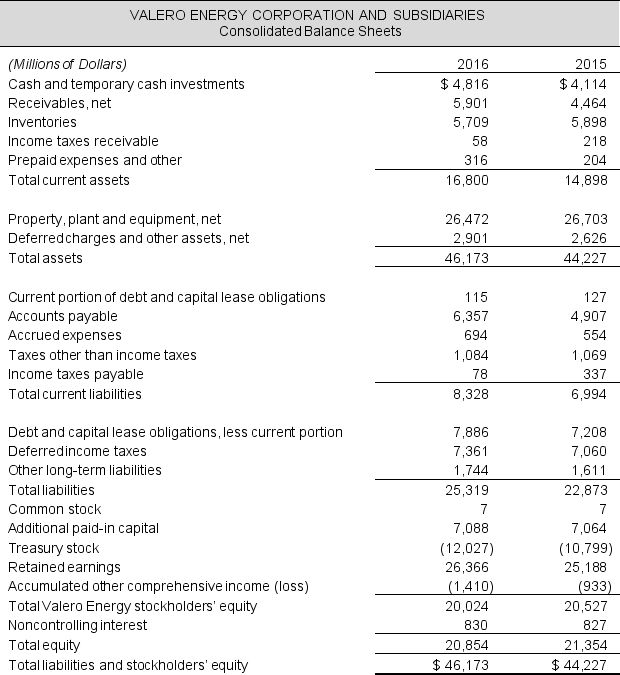

Use the following balance sheets and income statements for Valero Energy Corporation to answer the requirements.

Required:

Required:

a. Compute Valero's return on equity (ROE) for 2016 and 2015. Valero Energy stockholders' equity in 2014 was $20,677 million.

b. Compute the profit margin (PM), asset turnover (AT), and financial leverage (FL) components of the basic DuPont model. Show that ROE = PM × AT × FL for 2016. Total assets were $45,550 million in 2014. Which component(s) explain the year over year change in Valero's ROE?

c. Compute adjusted return on assets (ROA) for 2016 and 2015. Assume a tax rate of 37% for both years.

Correct Answer:

Verified

a. ROE = Net income attributable to Vale...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: The 2016 financial statements of The New

Q6: The fiscal 2016 financial statements of Nike

Q7: Income statements and balance sheets follow for

Q8: Use the income statement for Microsoft Corporation

Q9: Income statements and balance sheets follow for

Q11: Selected balance sheet and income statement data

Q12: Use the following selected balance sheet and

Q13: Explain how return on net operating assets

Q14: Income statements and balance sheets follow for

Q15: The fiscal 2016 financial statements of Nike