Multiple Choice

Figure 8-2

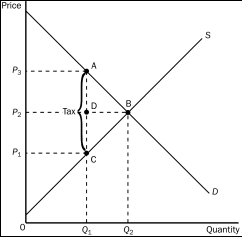

-Refer to Figure 8-2.Which of the following equations is valid for the deadweight loss of the tax?

A) Deadweight loss = (1/2) (P₂ - P₁) (Q₂ + Q₁)

B) Deadweight loss = (1/2) (P₃ - P₁) (Q₂ + Q₁)

C) Deadweight loss = (1/2) (P₃ - P₂) (Q₂ - Q₁)

D) Deadweight loss = (1/2) (P₃ - P₁) (Q₂ - Q₁)

Correct Answer:

Verified

Correct Answer:

Verified

Q23: Use the following graph shown to fill

Q24: One negative aspect of Henry George's single

Q25: To fully understand how taxes affect economic

Q28: A tax on a good<br>A)raises the price

Q28: Figure 8-2<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2178/.jpg" alt="Figure 8-2

Q29: The supply curve and the demand curve

Q31: Figure 8-4<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2178/.jpg" alt="Figure 8-4

Q36: Which of the following scenarios is not

Q71: When a tax on a good is

Q203: Because taxes distort incentives, they cause markets