Essay

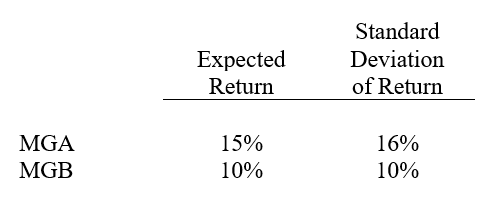

Consider the two following common stocks  The correlation coefficient between the returns for the two common stocks is .50. An investor plans to put 60% of his wealth in MGA common stock and 40% in MGB common stock.

The correlation coefficient between the returns for the two common stocks is .50. An investor plans to put 60% of his wealth in MGA common stock and 40% in MGB common stock.

(a)Determine the expected return for this portfolio.

(b)Determine the standard deviation of the portfolio's returns.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: The Economist Frank Knight and others sometimes

Q3: Simulation techniques used in risk analysis are:<br>A)

Q4: In the riskadjusted discount rate approach, the

Q5: For an individual having a utility function

Q6: Which of the following statements concerning marginal

Q7: Diminishing marginal utility:<br>A) indicates that the slope

Q8: A _ is a transaction that limits

Q9: A(n) _ creates the legal obligation for