Multiple Choice

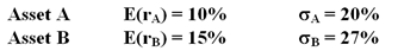

Two assets have the following expected returns and standard deviations when the risk-free rate is 5%: An investor with a risk aversion of A = 3 would find that ________ on a risk-return basis.

A) only Asset A is acceptable

B) only Asset B is acceptable

C) neither Asset A nor Asset B is acceptable

D) both Asset A and Asset B are acceptable

Correct Answer:

Verified

Correct Answer:

Verified

Q1: You are considering investing $1000 in a

Q2: You have an APR of 7.5% with

Q3: You have the following rates of return

Q4: The geometric average of -12%, 20% and

Q5: Based on the outcomes in the table

Q6: Consider the following limit order book of

Q7: Security A has a higher standard deviation

Q8: The formula is used to calculate the

Q9: If the bid price is $15.12 and

Q10: You have the following rates of return