Multiple Choice

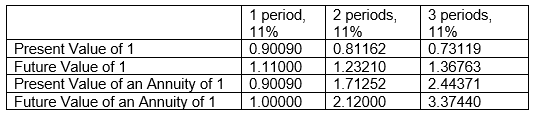

Gaynor Company is considering purchasing equipment.The equipment will produce the following cash flows: Year 1, $25,000; Year 2, $45,000; Year 3, $60,000.Below is some of the time value of money information that Gaynor has compiled that might help them in their planning and compounded interest decisions.  Gaynor requires a minimum rate of return of 11%.To the closest dollar, what is the maximum price Gaynor should pay for the equipment?

Gaynor requires a minimum rate of return of 11%.To the closest dollar, what is the maximum price Gaynor should pay for the equipment?

A) $317,682

B) $102,917

C) $165,253

D) $246,209

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Mitch has been offered three different contracts

Q3: Miracle Corporation wants to withdraw $60,000 from

Q4: This morning Roseland Inc.purchased a land for

Q5: Carter Holding Co.intends to purchase a new

Q6: For each of the following situations in

Q7: Karla Simpson Carson invested $12,000 at 8%

Q8: Everett Corporation issues a 8%, 9-year mortgage

Q9: Calculate the future value of equal semiannual

Q10: Morgan Company earns 11% on an investment

Q11: Mitch has been offered three different contracts