Short Answer

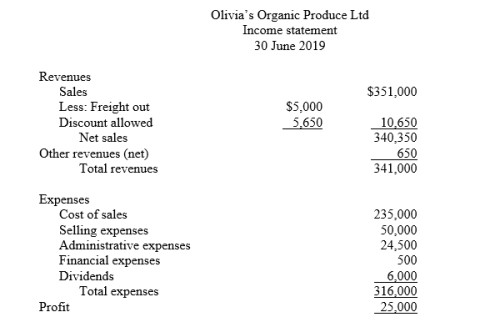

Your friend owns a small business supplying restaurants with fresh, organically grown produce. She prepares her own financial statements and has asked you to review the income statement she prepared for the financial year ended 30 June 2019:

As an experienced accountant, you review the statement and determine the following facts:

As an experienced accountant, you review the statement and determine the following facts:

1. Sales include $5,000 of deposits from customers for future sales orders.

2. Other revenues contain two items: interest expense $2,000 and interest revenue $2,650.

3. Selling expenses consist of sales salaries $38,000; advertising $5,000; depreciation on storage equipment $3,750; and sales commissions expense $3,250.

4. Administrative expenses consist of office salaries $9,500; electricity expense $4,000; rent expense $8,000; and insurance expense $3,500. Insurance expense includes $600 of prepaid insurance.

5. Financial expenses consist of $500 bank charges.

Required: Prepare a corrected fully classified income statement. You do not need to calculate income taxes.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Expenses that are associated with sales are

Q3: When a retailer makes a sale to

Q4: The gross profit is generally considered to

Q5: Match the items below by choosing the

Q6: The journal entry to record a credit

Q7: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB10017/.jpg" alt=" -The amount of

Q8: Match the items below by choosing the

Q9: Match the items below by choosing the

Q10: Match the items below by choosing the

Q11: Hammer Hardware sold goods to James Brown