Multiple Choice

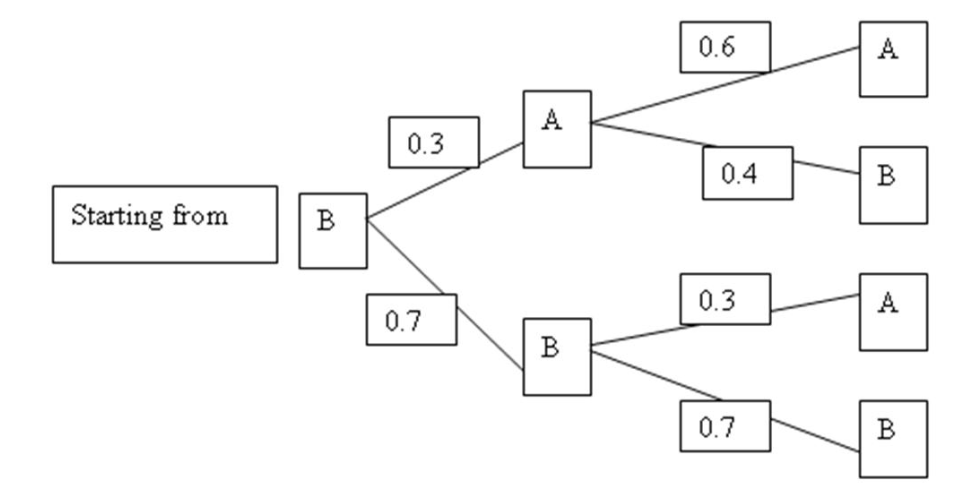

Jim Cramer, a stock analyst, models the movement of the closing price in NYSE of the stock WidgetsR-Us Inc. (symbol: WRU) as a Markov chain with a transition time of 1 day. There are two states in this Markov system-State A, the closing price increased or stayed the same from the previous day and State , the closing price decreased from the previous day. Suppose that the system is on State B as at the end of today, what is the probability that it will be in State B after two trading days (48 hours) ?

A) 0.52

B) 0.24

C) 0.28

D) 0.40

Correct Answer:

Verified

Correct Answer:

Verified

Q42: Judy Jones purchases groceries and pop

Q43: Judy Jones purchases groceries and pop exactly

Q44: XYZ Inc. hires only retired people for

Q45: Markov systems typically exist for one or

Q46: Newsweek and Time are two competing

Q47: Judy Jones purchases groceries and pop

Q48: If matrix <span class="ql-formula" data-value="\mathrm{A}"><span

Q49: Markov Analysis has many business applications, such

Q50: The rows of a transition probability matrix

Q51: Short term behavior of a Markov system