Multiple Choice

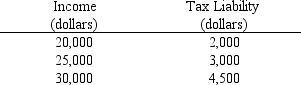

Use the table below to choose the correct answer.

The marginal tax rate on income in the $20,000 to $25,000 range is

A) 10 percent.

B) 12 percent.

C) 20 percent.

D) 30 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q5: Use the figure below to answer the

Q8: In the two decades following 1990, subsidized

Q25: Economic analysis indicates minimum wage legislation has<br>A)

Q55: Black markets that operate outside the legal

Q60: A tax for which the average tax

Q113: Use the figure below to answer the

Q117: A price floor that sets the price

Q123: The marginal tax rate is defined as<br>A)

Q184: The large amount of violence associated with

Q248: A substantial revision of the income tax