Multiple Choice

Figure 4-22

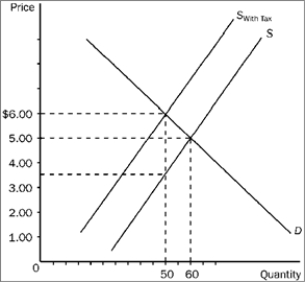

-Refer to Figure 4-22. The amount of the tax per unit is

A) $1.00.

B) $1.50.

C) $2.50.

D) $3.50.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q255: Figure 4-14 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-14

Q256: If a household has $40,000 in taxable

Q257: Other things constant, as the price of

Q258: The more elastic the supply of a

Q259: Use the figure below to answer the

Q261: Suppose the equilibrium price of a physical

Q262: Suppose the federal excise tax rate on

Q263: The average tax rate is defined as<br>A)

Q264: Which of the following statements is true?<br>A)

Q265: Suppose the U.S. Government banned the sale