Essay

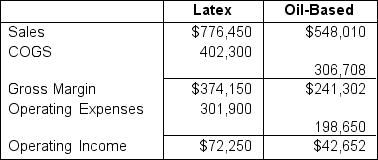

Dot Co. is a paint company, and it just completed its second quarter and is performing some analysis so that it can evaluate its top two paint divisions: Latex and Oil-Based. In their third quarter, the company has decided that it can give one or both divisions $15,000 of cash for investments if the analysis support it. Dot has requested that their head accountant gather some financial statement data and analyze it before they move forward with any potential investments. The accountant has compiled the following condensed income statements and selected balance sheet information for the second quarter:  In the second quarter, each division purchased a new piece of mixing equipment that cost $286,000. The company's effective tax rate is 23%, it has a Required Rate of Return of 8.5%, and its Weighted Average Cost of Capital (WACC) is 7.6%. Use this information to answer the following questions.

In the second quarter, each division purchased a new piece of mixing equipment that cost $286,000. The company's effective tax rate is 23%, it has a Required Rate of Return of 8.5%, and its Weighted Average Cost of Capital (WACC) is 7.6%. Use this information to answer the following questions.

a. What are the Return on Investment (ROI), Residual Income (RI), and the Economic Value Added (EVA) for the Latex Division?

b. What are the Return on Investment (ROI), Residual Income (RI), and the Economic Value Added (EVA) for the Oil-Based Division?

c. Based on this initial analysis, will either department be granted money to pursue the additional investment?

Correct Answer:

Verified

a. ROI = 25.26%, RI = $47,940.00, and EV...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: Karen owns a small company that has

Q4: A small surveying company has decided they

Q5: Kit works for a company that creates

Q6: In an effort to optimize decentralization, work

Q7: Comfy Critters is a factory that creates

Q9: After a company has decided to vertically

Q10: The Production Department of Ollie Corp. has

Q11: The Riggs Company manufactures monogrammed t-shirts that

Q12: Turner Inc. is a factory that creates

Q13: In a decentralized organization, business units are