Essay

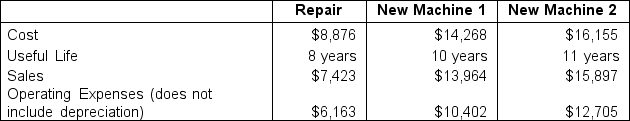

Comfy Critters is a factory that creates stylish and comfortable bedding for dogs of all sizes. They are entering their 6th year of business, and they have decided that one of their largest sewing machines is nearing the end of its useful life. Their production manager, Todd, is trying to help management decide how best to proceed with their next steps. Todd has the choices narrowed down to repairing the current machine (Repair), or replacing the machine with one of two different replacement options (New Machine 1 or New Machine 2). The numbers associated with each of these options are as follows:  The company has chosen to utilize the straight-line method of depreciation calculation. The company has utilized a variety means to raise capital, and it is allocated as follows:

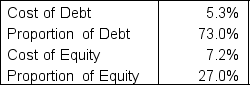

The company has chosen to utilize the straight-line method of depreciation calculation. The company has utilized a variety means to raise capital, and it is allocated as follows:  Comfy Critters has a tax rate of 25% and a Required Rate of Return of 8.4%. (Do not round your calculations.)

Comfy Critters has a tax rate of 25% and a Required Rate of Return of 8.4%. (Do not round your calculations.)

a. What is the Weighted Average Cost of Capital (WACC) for Comfy Critters?

b. What are the Return on Investment (ROI), Residual Income (RI), and Economic Value Added (EVA) for the Repair option?

c. What are the Return on Investment, Residual Income, and Economic Value Added for the New Machine 1 option?

d. What are the Return on Investment, Residual Income, and Economic Value Added for the New Machine 2 option?

e. What should Todd recommend to management based on the analyses in parts b, c, and d? Provide as much detail as possible to support that decision.

Correct Answer:

Verified

a. WACC = 5.81% This question requires f...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Ingen Production manufactures a top-of-the-line record player,

Q3: Karen owns a small company that has

Q4: A small surveying company has decided they

Q5: Kit works for a company that creates

Q6: In an effort to optimize decentralization, work

Q8: Dot Co. is a paint company, and

Q9: After a company has decided to vertically

Q10: The Production Department of Ollie Corp. has

Q11: The Riggs Company manufactures monogrammed t-shirts that

Q12: Turner Inc. is a factory that creates