Essay

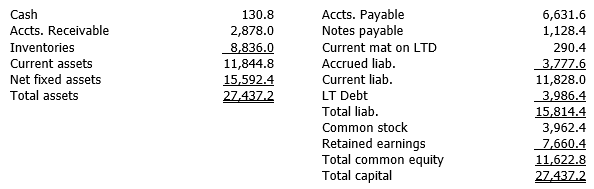

Witten Publishing, a U.S. multinational, has a subsidiary in Mexico with the following balance sheet (denominated in pesos).

The spot exchange rate is $0.097430/peso. The company's CFO has estimated the following average exchange rates for inventories, fixed assets, common stock, and retained earnings: $0.109240, $0.103580, $0.101160, and $0.121641, respectively. The subsidiary is classified as an integrated foreign entity. Translate the balance sheet into U.S. dollars, which is the reporting currency. (Hint: Depending upon the translation method used, all of the exchange rates may not be used.)

The spot exchange rate is $0.097430/peso. The company's CFO has estimated the following average exchange rates for inventories, fixed assets, common stock, and retained earnings: $0.109240, $0.103580, $0.101160, and $0.121641, respectively. The subsidiary is classified as an integrated foreign entity. Translate the balance sheet into U.S. dollars, which is the reporting currency. (Hint: Depending upon the translation method used, all of the exchange rates may not be used.)

Financial statement translation Diff: T

Correct Answer:

Verified

Since the subsidiary is an integrated fo...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: Which of the following statements are correct?<br>A)

Q16: If a subsidiary is in a country

Q17: Gard Tennis Supply, a U.S. multinational, has

Q18: If the temporal method for translating foreign

Q19: Regarding translation methodologies, which of the following

Q20: After all foreign entity financial statements have

Q21: How does a company develop a hedged

Q22: Accounting or translation exposures give rise to

Q23: Which of the following statements is incorrect?<br>A)

Q24: The Financial Accounting Standards Board (FASB) in