Essay

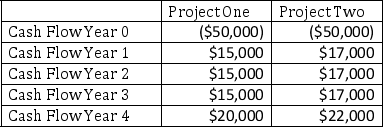

Steif Corporation has two investment projects it is considering. Financial capital is scarce, so Steif wants to choose the project that promises the highest returns to the company and its shareholders. The company's weighted average cost of capital is 14%. The projected cash flows from both projects are given below.

Required:

Required:

a) Calculate the present value of each of the projects using the 14% weighted average cost of capital as the discount rate.

b) Which, if either, of the projects should the company choose? Why?

Correct Answer:

Verified

Steif Corporation has two investment pro...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q53: KHD Industries includes, among others, the following

Q54: Morrison's Plastics Division, a profit center, sells

Q55: The direct method of service department cost

Q56: One reason for allocating the costs of

Q57: Before becoming a publicly traded corporation, Groupon,

Q59: The John Deere Corporation is organized into

Q60: P & M Corporation manufactures products exclusively

Q61: Among its other assets, your company owns

Q62: One of the significant costs of decentralization

Q63: Of the various types of responsibility centers