Essay

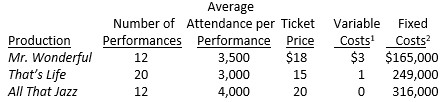

Starlight Theater stages a number of summer musicals at its theater in northern Ohio. Preliminary planning has just begun for the upcoming season, and Starlight has developed the following estimated data.

1 Represent payments to production companies and are based on tickets sold.

1 Represent payments to production companies and are based on tickets sold.

2 Costs directly associated with the entire run of each production for costumes, sets, and artist fees.

Starlight will also incur $565,000 of common fixed operating charges (administrative overhead, facility costs, and advertising) for the entire season, and is subject to a 30% income tax rate. These common charges are allocated based on total attendance for each production.

Required:

a. What is Starlight's product mix?

b. What is Starlight's package contribution margin?

c. If Starlight's schedule of musicals is held, as planned, how many patrons would have to attend for Starlight to break even during the summer season? How many tickets for each type of musical does it need to sell in order to break even?

d. What is Starlight Theater's current profit for the business?

e. What is Starlight Theater's current margin of safety in terms of revenue dollars?

f. Starlight Theater wants to make a profit of $1,500,000 for the season before taxes. How many patrons would have to attend now? What is the required revenue dollars of sales?

g. Now Starlight Theater wants this profit in after-tax dollars. How many patrons would have to attend now? What are the required revenue dollars of sales?

Correct Answer:

Verified

Correct Answer:

Verified

Q26: Thompson Company produces scientific and business calculators.

Q27: Wilkinson Company sells its single product

Q28: Nochance.com has not reported a profit in

Q29: Specialty Cakes Inc. produces two types

Q30: What is the relationship between

Q32: Cell Company has discovered that

Q33: Thompson Company produces scientific and business calculators.

Q34: A firm's cost structure is its mix

Q35: Carson Inc. manufactures only one product

Q36: All of the following are assumptions