Essay

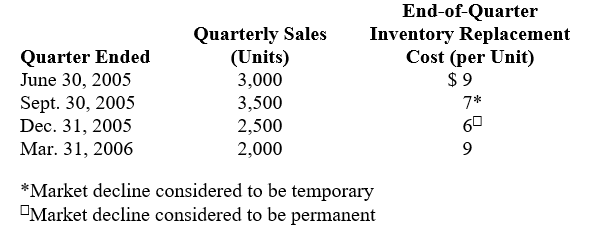

Wasco Company, which has a March 31 fiscal year, issues interim financial reports. Wasco sells a single unit of merchandise; the merchandise inventory, at first-in, first-out cost, was 14,000 units, $112,000, on April 1, 2005. Wasco purchased no merchandise during the year ended March 31, 2006. Quarterly sales and end-of-quarter merchandise replacement costs for the year ended March 31, 2006, were as follows:

Prepare a working paper to compute Wasco Company's cost of goods sold for the four quarters of the year ended March 31, 2006. Use the following headings:

Prepare a working paper to compute Wasco Company's cost of goods sold for the four quarters of the year ended March 31, 2006. Use the following headings:

Correct Answer:

Verified

Correct Answer:

Verified

Q22: For the fiscal year ended June 30,

Q23: <B>FASB Statement No. 131, </B>"Disclosures about Segments

Q24: Which of the following is not required

Q25: <B>Staff Accounting Bulletins</B> issued by the SEC

Q26: Management of a business enterprise has the

Q28: The trading of securities on national securities

Q29: Switzer Company's accounting records for the fiscal

Q30: The nontraceable expenses of Wick Company's corporate

Q31: If an operating segment has been discontinued

Q32: Chan Company's statutory income tax rate is