Essay

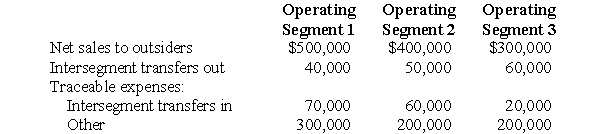

Switzer Company's accounting records for the fiscal year ended May 31, 2006, included the following information for its three operating segments:

Nontraceable expenses of Switzer were $120,000 for the year ended May 31, 2006. Switzer allocates these expenses on the basis of segment sales to outsiders.

Nontraceable expenses of Switzer were $120,000 for the year ended May 31, 2006. Switzer allocates these expenses on the basis of segment sales to outsiders.

Prepare a working paper to compute the profit or loss of each of Switzer's three operating segments for the year ended May 31, 2006.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: Which of the following is not required

Q25: <B>Staff Accounting Bulletins</B> issued by the SEC

Q26: Management of a business enterprise has the

Q27: Wasco Company, which has a March 31

Q28: The trading of securities on national securities

Q30: The nontraceable expenses of Wick Company's corporate

Q31: If an operating segment has been discontinued

Q32: Chan Company's statutory income tax rate is

Q33: On April 30, 2006, Raye Company, which

Q34: If a new effective income tax rate