Essay

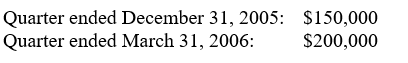

On October 1, 2005, Anaconda Company estimated an effective income tax rate of 42% for the fiscal year ending September 30, 2006. On January 2, 2006, Anaconda changed the estimate to 38%. Pre-tax financial income for Anaconda for the first two quarters of the fiscal year ending September 30, 2006, was as follows:

Prepare journal entries for income taxes expense for Anaconda Company on December 31, 2005, and March 31, 2006. Show supporting computations in explanations for the journal entries.

Prepare journal entries for income taxes expense for Anaconda Company on December 31, 2005, and March 31, 2006. Show supporting computations in explanations for the journal entries.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Which of the following SEC requirements generally

Q3: For interim reports, an inventory loss from

Q4: To disclose a recent business combination, a

Q5: Which of the following is not used

Q6: Do the disclosures related to segment profit

Q7: <B>FASB Statement No. 131,</B> "Disclosures about Segments

Q8: The computation of a business enterprise's third-quarter

Q9: Methods that have been used to allocate

Q10: In its interim report for the three

Q11: A company may issue a <B>Form 8-K