Essay

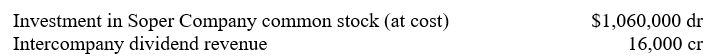

Selected ledger account balances (before closing entries) of Pome Corporation on September 30, 2006, one year after the business combination with an 80%-owned subsidiary, were as follows:

The carrying amount of Soper's identifiable net assets on September 30, 2005, was $1,200,000, which was the same as their current fair value on that date. Soper had a net income of $80,000 and declared and paid dividends of $20,000 during the fiscal year ended September 30, 2006. Goodwill was unimpaired on September 30, 2006.

The carrying amount of Soper's identifiable net assets on September 30, 2005, was $1,200,000, which was the same as their current fair value on that date. Soper had a net income of $80,000 and declared and paid dividends of $20,000 during the fiscal year ended September 30, 2006. Goodwill was unimpaired on September 30, 2006.

Prepare an adjusting entry on September 30, 2006, to convert Pome Corporation's accounting for the operations of Soper Company to the equity method of accounting from the cost method of accounting. Disregard income taxes.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Dividends declared by a subsidiary subsequent to

Q9: Refer to the above facts. Assume that,

Q10: A wholly owned subsidiary credits the Dividends

Q11: Under the equity method of accounting, the

Q12: Under the equity method of accounting, a

Q14: Which of the following is not typical

Q15: The working paper elimination (in journal entry

Q16: Which of the following does not affect

Q17: The Retained Earnings of Subsidiary ledger account

Q18: A parent company that uses the cost