Essay

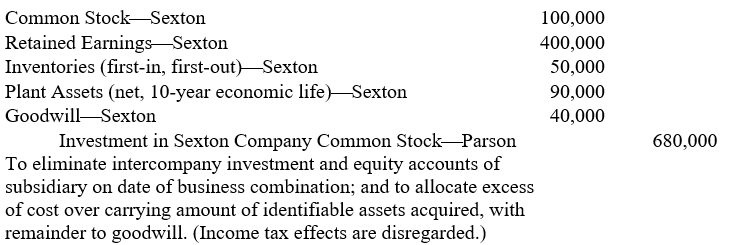

The working paper elimination (in journal entry format) for Parson Corporation and subsidiary on February 28, 2005, (the date of the business combination) was as follows:

For the fiscal year ended February 28, 2006, Sexton had a net income of $120,000 and declared a dividend of $40,000 to Parson. Sexton includes straight-line depreciation in operating expenses. Goodwill was unimpaired on February 28, 2006.

For the fiscal year ended February 28, 2006, Sexton had a net income of $120,000 and declared a dividend of $40,000 to Parson. Sexton includes straight-line depreciation in operating expenses. Goodwill was unimpaired on February 28, 2006.

Prepare a working paper elimination (in journal entry format) for Parson Corporation and subsidiary on February 28, 2006. Omit explanation and disregard income taxes.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: A wholly owned subsidiary credits the Dividends

Q11: Under the equity method of accounting, the

Q12: Under the equity method of accounting, a

Q13: Selected ledger account balances (before closing entries)

Q14: Which of the following is not typical

Q16: Which of the following does not affect

Q17: The Retained Earnings of Subsidiary ledger account

Q18: A parent company that uses the cost

Q19: Goodwill attributable to a business combination involving

Q20: To recognize the impairment of goodwill arising