Multiple Choice

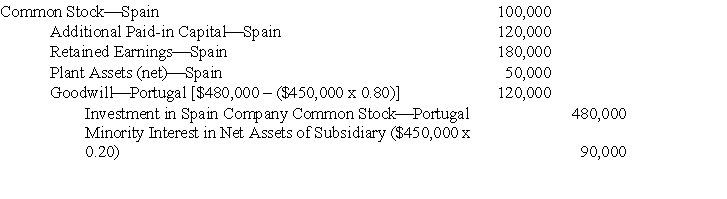

On October 31, 2006, Portugal Corporation acquired 80% of the outstanding common stock of Spain Company in a business combination. Total cost of the investment, including direct out-of-pocket costs, was $480,000. The working paper elimination (in journal entry format, explanation omitted) for Portugal Corporation and Subsidiary on October 31, 2006, was as follows:  If minority interest in net assets of subsidiary had been reflected at carrying amount, rather than at current fair value, of the subsidiary's identifiable net assets, the credit to Minority Interest in Net Assets of Subsidiary in the foregoing elimination would have been:

If minority interest in net assets of subsidiary had been reflected at carrying amount, rather than at current fair value, of the subsidiary's identifiable net assets, the credit to Minority Interest in Net Assets of Subsidiary in the foregoing elimination would have been:

A) $90,000

B) $120,000

C) $60,000

D) Some other amount

Correct Answer:

Verified

Correct Answer:

Verified

Q5: On May 31, 2006, Ping Corporation paid

Q6: On March 31, 2006, Preston Corporation acquired

Q7: In a business combination resulting in a

Q8: Under the<B> parent company concept </B>of consolidated

Q9: A parent company's journal entries to record

Q11: In a business combination that establishes a

Q12: A parent company's control of a subsidiary

Q13: Consolidated financial statements are intended primarily for

Q14: In a business combination resulting in a

Q15: Consolidated financial statements emphasize the legal form