Essay

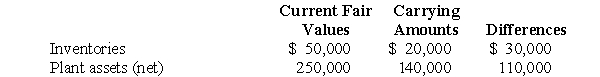

On May 31, 2006, Ping Corporation paid $300,000, including direct out-of-pocket costs of the business combination, for 82% of the outstanding common stock of Spring Company, which became a subsidiary. Differences between current fair values and carrying amounts of identifiable net assets of Spring Company on May 31, 2006, were limited to the following:

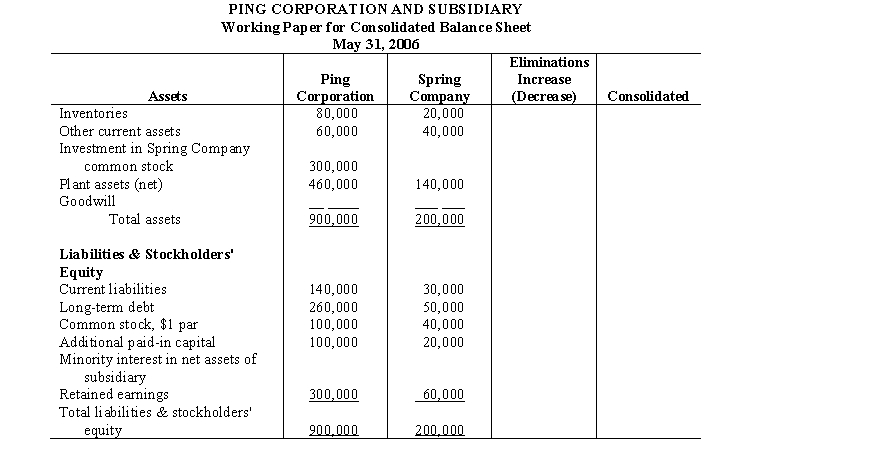

Complete the following working paper for consolidated balance sheet of Ping Corporation and subsidiary. Do not prepare a working paper elimination in journal entry format; however, explain the elimination on the working paper. Disregard income taxes.

Complete the following working paper for consolidated balance sheet of Ping Corporation and subsidiary. Do not prepare a working paper elimination in journal entry format; however, explain the elimination on the working paper. Disregard income taxes.

Explanation of elimination: (a)

Explanation of elimination: (a)

Correct Answer:

Verified

Explanation of elimination:

Explanation of elimination:

(...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

(...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: On June 30, 2006, Purdom Corporation acquired

Q2: Punt Corporation acquired a controlling interest in

Q3: Goodwill recognized in a business combination of

Q4: Only the balance sheet is consolidated on

Q6: On March 31, 2006, Preston Corporation acquired

Q7: In a business combination resulting in a

Q8: Under the<B> parent company concept </B>of consolidated

Q9: A parent company's journal entries to record

Q10: On October 31, 2006, Portugal Corporation acquired

Q11: In a business combination that establishes a