Essay

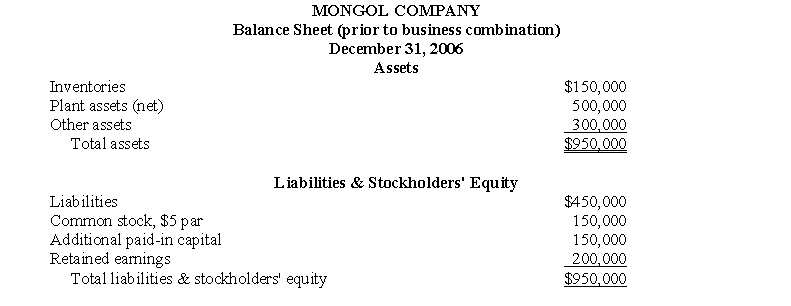

The balance sheet of Mongol Company on December 31, 2006, prior to its merger with Solway Corporation, was as follows:

On December 31, 2006, Solway issued 60,000 of its $10 par (current fair value $15) common stock for all the outstanding common stock of Mongol, which was then liquidated. Also on December 31, 2006, Solway paid $60,000 out-of-pocket costs in connection with the business combination, of which $25,000 were finder's, accounting, and legal fees directly related to the combination, and $35,000 were costs of registering and issuing the common stock to effect the combination. Current fair values of Mongol's inventories and plant assets were $180,000 and $620,000, respectively; other assets and liabilities had current fair values equal to their carrying amounts.

On December 31, 2006, Solway issued 60,000 of its $10 par (current fair value $15) common stock for all the outstanding common stock of Mongol, which was then liquidated. Also on December 31, 2006, Solway paid $60,000 out-of-pocket costs in connection with the business combination, of which $25,000 were finder's, accounting, and legal fees directly related to the combination, and $35,000 were costs of registering and issuing the common stock to effect the combination. Current fair values of Mongol's inventories and plant assets were $180,000 and $620,000, respectively; other assets and liabilities had current fair values equal to their carrying amounts.

Prepare journal entries on December 31, 2006, for Solway Corporation to record the business combination with Mongol Company. Disregard income taxes.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Slocum Corporation and Merton Company, both publicly

Q2: In a statutory merger, all except one

Q3: On May 1, 2006, Regis Corporation acquired

Q5: Paragraph 43 of <B>FASB Statement No. 141,

Q6: The balance sheet of Mintmore Company on

Q7: A bargain purchase excess in a business

Q8: The issuer of common stock in a

Q9: In a business combination, the appropriate accounting

Q10: Carrying amounts of the combinee's identifiable net

Q11: Direct out-of-pocket costs of a business combination