Essay

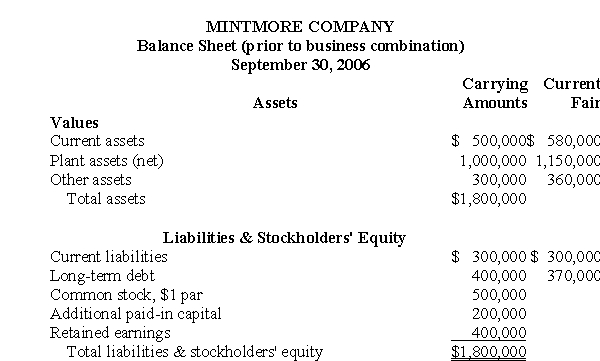

The balance sheet of Mintmore Company on September 30, 2006, with related current fair values for assets and liabilities, is shown as follows:

On September 30, 2006, Spooner Corporation paid $1,560,000 to Mintmore Company for all the Mintmore assets except its cash of $50,000, and assumed all liabilities of Mintmore, in a business combination that had been approved by the boards of directors and stockholders of both companies. Also on September 30, 2006, Spooner paid legal fees of $20,000 incurred to implement the business combination.

On September 30, 2006, Spooner Corporation paid $1,560,000 to Mintmore Company for all the Mintmore assets except its cash of $50,000, and assumed all liabilities of Mintmore, in a business combination that had been approved by the boards of directors and stockholders of both companies. Also on September 30, 2006, Spooner paid legal fees of $20,000 incurred to implement the business combination.

Prepare journal entries for Spooner Corporation on September 30, 2006, to record the business combination with Mintmore Company. Disregard income taxes.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Slocum Corporation and Merton Company, both publicly

Q2: In a statutory merger, all except one

Q3: On May 1, 2006, Regis Corporation acquired

Q4: The balance sheet of Mongol Company on

Q5: Paragraph 43 of <B>FASB Statement No. 141,

Q7: A bargain purchase excess in a business

Q8: The issuer of common stock in a

Q9: In a business combination, the appropriate accounting

Q10: Carrying amounts of the combinee's identifiable net

Q11: Direct out-of-pocket costs of a business combination