Multiple Choice

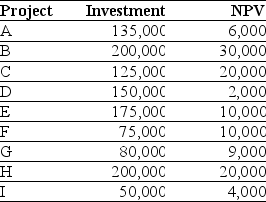

Use the table for the question(s) below.

Consider the following list of projects:

-Assume that your capital is constrained,so that you only have $500,000 available to invest in projects.If you invest in the optimal combination of projects given your capital constraint,then the total net present value (NPV) for all the projects you invest in will be closest to:

A) $111,000

B) $69,000

C) $80,000

D) $58.000

E) $90,000

Correct Answer:

Verified

Correct Answer:

Verified

Q2: You have an investment opportunity that will

Q4: Net present value (NPV) is usefully supplemented

Q8: Use the information for the question(s)below.<br>The Sisyphean

Q10: Use the table for the question(s)below.<br>Consider a

Q11: When comparing two projects with different lives,why

Q76: Should personal preferences for cash today versus

Q89: Net present value (NPV) is the difference

Q101: The payback rule is based on the

Q104: What is the Net Present Value rule?

Q110: When comparing mutually exclusive projects which have