Multiple Choice

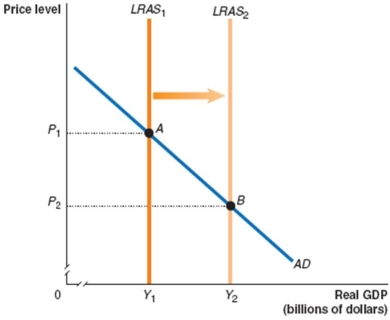

Refer to Figure 13.6 for the following questions.

Figure 13.6

-Suppose the federal government reduces income taxes. Assume that the movement from A to B in Figure 13.6 represents normal growth in the economy before the tax change. If the tax change is not effective and labour supply and savings do not increase because of the tax change, then the tax change will:

A) decrease the price level below P₂.

B) increase output above Y₂.

C) not change the price level.

D) shift LRAS₂ to the right.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Explain why 'crowding out' might still occur

Q21: Show the effects of tax reduction and

Q22: Use the following information to explain and

Q23: The nominal wage, expected inflation, and actual

Q24: Suppose real GDP is $13 trillion, potential

Q26: 'Contractionary fiscal policy' aims to reduce the

Q27: What is the government purchases multiplier if

Q28: Suppose real GDP is $1.3 trillion and

Q29: If the government purchases multiplier equals 2,

Q30: Refer to Figure 13.2 for the following