Essay

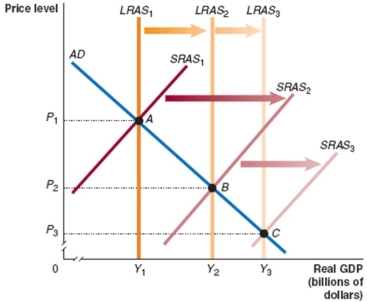

Show the effects of tax reduction and simplification using the dynamic aggregate demand and supply model. To simplify the analysis, assume that the aggregate demand curve does not change. How does the analysis change if the tax change does not change labour supply and has little or no effect on savings and investment?

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Correct Answer:

Verified

The economy's initial equilibrium is at ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Induced taxes and transfer payments reduce the

Q18: Refer to Figure 13.1 for the following

Q19: A vertical long-run Phillips curve implies that

Q20: Explain why 'crowding out' might still occur

Q22: Use the following information to explain and

Q23: The nominal wage, expected inflation, and actual

Q24: Suppose real GDP is $13 trillion, potential

Q25: Refer to Figure 13.6 for the following

Q26: 'Contractionary fiscal policy' aims to reduce the

Q125: The multiplier effect is the series of