Multiple Choice

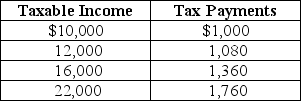

Table 18-8

Table 18-8 shows the amount of taxes paid on various levels of income.

-Refer to Table 18-8.The tax system is

A) progressive throughout all levels of income.

B) proportional throughout all levels of income.

C) regressive throughout all levels of income.

D) progressive between $10,000 and $12,000 of income and regressive between $12,000 and $22,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q164: The Arrow impossibility theorem explains<br>A)why there is

Q165: Describe each of the principles governments consider

Q166: Table 18-4<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Table 18-4

Q167: The public choice model raises questions about

Q168: Income inequality in the United States has

Q170: What is regulatory capture?<br>A)It is a situation

Q171: Gasoline taxes that are typically used for

Q172: "For a given supply curve, the excess

Q173: Last year, Anthony Millanti earned exactly $30,000

Q174: A situation where a member of Congress