Essay

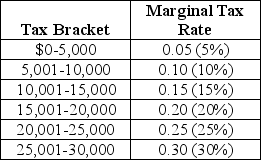

Last year, Anthony Millanti earned exactly $30,000 of taxable income.Assume that the income tax system used to determine Anthony's tax liability is progressive.The table below lists the tax brackets and the marginal tax rates that apply to each bracket.

a.Draw a new table that lists the amounts of income tax that Anthony is obligated to pay for each tax bracket, and the total tax he owes the government.(Assume that there are no allowable tax deductions, tax credits, personal exemptions, or any other deductions that Anthony can use to reduce his tax liability).

b.Determine Anthony's average tax rate.

Correct Answer:

Verified

a.

b.The average tax rate i...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b.The average tax rate i...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q168: Income inequality in the United States has

Q169: Table 18-8<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Table 18-8

Q170: What is regulatory capture?<br>A)It is a situation

Q171: Gasoline taxes that are typically used for

Q172: "For a given supply curve, the excess

Q174: A situation where a member of Congress

Q175: In reference to the federal income tax

Q176: Which of the following is an example

Q177: Vertical-equity is most closely associated with which

Q178: If you pay $14,000 in taxes on