Multiple Choice

Table 18-9

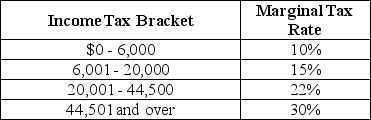

Table 18-9 shows the income tax brackets and tax rates for single taxpayers in Monrovia.

-Refer to Table 18-9.How much income tax does Sylvia pay if she is a single taxpayer with an income of $70,000?

A) $21,000

B) $15,740

C) $15,400

D) $13,475

Correct Answer:

Verified

Correct Answer:

Verified

Q120: According to the benefits-received principle of taxation<br>A)individuals

Q121: A tax is efficient if it imposes

Q122: For a given supply curve, how does

Q123: Figure 18-1<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Figure 18-1

Q124: A common belief among political analysts is

Q126: Figure 18-1<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Figure 18-1

Q127: The voting paradox suggests that the "voting

Q128: If you pay $2,000 in taxes on

Q129: Figure 18-2<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Figure 18-2

Q130: A statistical tool used to measure income