Multiple Choice

Figure 18-1

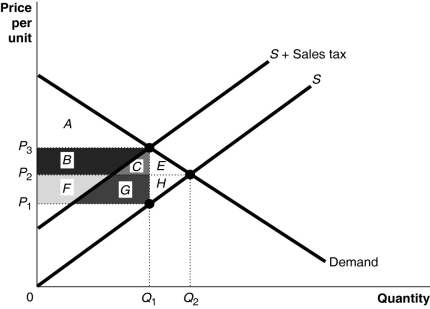

-Refer to Figure 18-1.Area B + C represents

A) the portion of sales tax revenue borne by consumers.

B) the portion of sales tax revenue borne by producers.

C) the excess burden of the sales tax.

D) sales tax revenue collected by the government.

Correct Answer:

Verified

Correct Answer:

Verified

Q121: A tax is efficient if it imposes

Q122: For a given supply curve, how does

Q123: Figure 18-1<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Figure 18-1

Q124: A common belief among political analysts is

Q125: Table 18-9<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Table 18-9

Q127: The voting paradox suggests that the "voting

Q128: If you pay $2,000 in taxes on

Q129: Figure 18-2<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Figure 18-2

Q130: A statistical tool used to measure income

Q131: Table 18-6<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Table 18-6