Multiple Choice

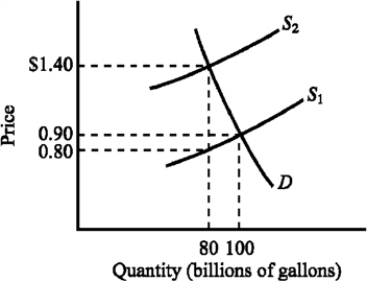

Use the figure below to answer the following question(s) .

Figure 4-7

-Refer to Figure 4-7. Which of the following is true for the tax illustrated?

A) The tax increases the price of gasoline by $.60.

B) Since the demand for gasoline is more inelastic than the supply, consumers bear most of the burden of the tax.

C) Since the demand for gasoline is more elastic than the supply, consumers bear most of the burden of the tax.

D) Since the supply of gasoline is highly inelastic, the primary burden of the tax is imposed on the suppliers of gasoline.

Correct Answer:

Verified

Correct Answer:

Verified

Q80: When a price ceiling prevents a higher

Q81: The state of Florida is considering putting

Q82: A progressive tax<br>A) is one that taxes

Q83: Suppose the market equilibrium price of wheat

Q84: Which of the following generalizations about the

Q86: Use the figure below to answer the

Q87: Use the figure below to answer the

Q88: If the government wants to raise tax

Q89: Use the figure below to answer the

Q90: Data from the effects of the substantial