Multiple Choice

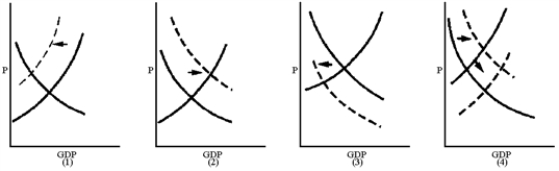

Figure 11-2

-The Bush tax cuts

A) reduced tax rates for the upper brackets and increased tax rates for lower-income taxpayers.

B) reduced tax rates for the upper brackets and held constant tax rates for lower-income taxpayers.

C) reduced tax rates for the upper brackets and decreased tax rates for lower-income taxpayers.

D) held constant tax rates for the upper brackets and decreased tax rates for lower-income taxpayers.

E) Increased tax rates for the upper brackets and decreased tax rates for lower-income taxpayers.

Correct Answer:

Verified

Correct Answer:

Verified

Q174: Figure 11-3<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8592/.jpg" alt="Figure 11-3

Q175: Critics of supply-side economics argue that a

Q176: Figure 11-3<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8592/.jpg" alt="Figure 11-3

Q177: Government purchases have the same multiplier effect

Q178: Why did President George W.Bush feel the

Q180: Table 11-1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8592/.jpg" alt="Table 11-1

Q181: Government transfer payments act as automatic stabilizers

Q182: If personal income taxes are increased, disposable

Q183: If a "liberal" wanted to decrease aggregate

Q184: Income tax acts as a shock absorber