Essay

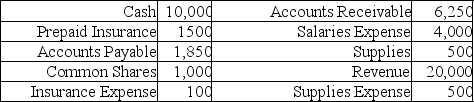

Whitney's Music School account balances on January 31, 2013 are below. All accounts have normal balances. The income tax rate is 30%.

Required:

1. Prepare the unadjusted trial balance as of December 31, 2013.

2. Journalize and post the adjusting journal entries based on the following information.

a. Accrue Salary, $1500.

b. Record the expiration insurance, 500.

c. Supplies on hand, $100.

3. Prepare an adjusted trial balance as of December 31, 2013.

4. Journalize and post the closing entries.

5. Prepare a post-closing trial balance at December 31, 2013.

Correct Answer:

Verified

Parts 1, 3, & 5

Unadjusted Adjustments A...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Unadjusted Adjustments A...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q45: It does not matter when a fiscal

Q117: Respectively, cash, rent expense, and accounts payable

Q118: Taxes payable would be an example of

Q119: The value of an asset after all

Q120: Dividend accounts are closed by crediting them

Q122: Journalize the following entries for March 31.

Q123: The total revenues of $6,500, total expenses

Q124: The supplies account must be adjusted to

Q125: An example of a contra-account would be

Q153: Accounting for revenue on an accrual basis