Essay

Table 4-5

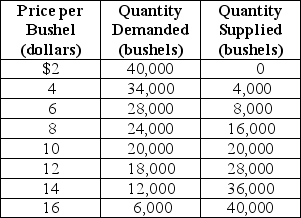

Table 4-5 above contains information about the corn market. Answer the following questions based on this table.

-Refer to Table 4-5.An agricultural price floor is a price that the government guarantees farmers will receive for a particular crop.Suppose the federal government sets a price floor for corn at $12 per bushel.

a.What is the amount of shortage or surplus in the corn market as result of the price floor?

b.If the government agrees to purchase any surplus output at $12, how much will it cost the government?

c.If the government buys all of the farmers' output at the floor price, how many bushels of corn will it have to purchase and how much will it cost the government?

d.Suppose the government buys up all of the farmers' output at the floor price and then sells the output to consumers at whatever price it can get.Under this scheme, what is the price at which the government will be able to sell off all of the output it had purchased from farmers? What is the revenue received from the government's sale?

e.In this problem we have considered two government schemes: (1)a price floor is established and the government purchases any excess output and (2)the government buys all the farmers' output at the floor price and resells at whatever price it can get.Which scheme will taxpayers prefer?

f.Consider again the two schemes.Which scheme will the farmers prefer?

g.Consider again the two schemes.Which scheme will corn buyers prefer?

Correct Answer:

Verified

a.10,000 surplus.

b.$12 × 10,000 = $120,...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b.$12 × 10,000 = $120,...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q169: Consumers are willing to purchase a product

Q170: If the market price is at equilibrium,

Q171: Economic efficiency in a competitive market is

Q172: The sum of consumer surplus and producer

Q173: Economic efficiency is a market outcome in

Q175: Figure 4-1<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Figure 4-1

Q176: The government proposes a tax on imported

Q177: Figure 4-1<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Figure 4-1

Q178: Figure 4-8<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Figure 4-8

Q179: Which of the following statements best describes