Essay

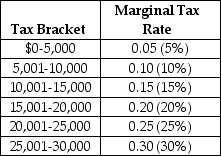

Last year, Anthony Millanti earned exactly $30,000 of taxable income.Assume that the income tax system used to determine Anthony's tax liability is progressive.The table below lists the tax brackets and the marginal tax rates that apply to each bracket.

a.Draw a new table that lists the amounts of income tax that Anthony is obligated to pay for each tax bracket, and the total tax he owes the government.(Assume that there are no allowable tax deductions, tax credits, personal exemptions, or any other deductions that Anthony can use to reduce his tax liability).

b.Determine Anthony's average tax rate.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: At the state and local levels in

Q67: Economists often analyze the interaction of individuals

Q69: If the marginal tax rate is less

Q72: Figure 18-2<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Figure 18-2

Q80: Table 18-6<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Table 18-6

Q94: In the United States, taxpayers are allowed

Q115: Logrolling refers to attempts by individuals to

Q149: When the demand for a product is

Q178: If you pay $14,000 in taxes on

Q202: Figure 18-7<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Figure 18-7