Essay

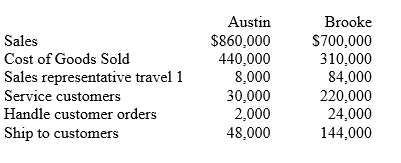

Brent Company's cost system assigns MSDA expenses to customers using a rate of 33% of sales revenue.The new CFO has discovered that Brent's customers differ greatly in their ordering patterns and interaction with Brent's sales force.Because the CFO believes Brent's cost system does not accurately assign MSDA expenses to customers,he developed an ABC system and gathered the following information.

Required:

(a)Using the current cost system's approach of assigning MSDA expenses to customers using a rate of 33% of sales revenue,determine the operating profit associated with Austin and with Brooke.

(b)Using the activity-based costing information provided,determine the operating profit associated with Austin and with Brooke.

(c)Which of the two methods produces more accurate assignments of MSDA expenses to customers? Explain.

Correct Answer:

Verified

(c)

The activity-based costing method ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

(c)

The activity-based costing method ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Compare the 80-20 rule and the whale

Q24: The whale curve shows:<br>A)the most profitable 20%

Q25: Omega Company has the following two customers:

Q26: The 80/20 rules states that the top

Q27: Discuss the issues related to excessive focus

Q29: Discounts given to encourage large purchases are

Q30: Low cost to serve customers:<br>A)have low order

Q31: Customer loyalty is characterized by a customer's

Q32: Customers that require a low price and

Q33: Customer profitability:<br>A)is reflected by gross margin.<br>B)are most