Essay

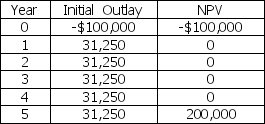

The Bolster Company is considering two mutually exclusive projects:

The required rate of return on these projects is 12 percent.

a.What is each project's payback period?

b.What is each project's discounted payback period?

c.What is each project's net present value?

d.What is each project's internal rate of return?

e.Fully explain the results of your analysis.Which project do you prefer,and why?

Correct Answer:

Verified

a.Payback of A = 3.2 years Payback of B ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q147: Your firm is considering an investment that

Q148: The profitability index can be helpful when

Q149: The Meacham Tire Company is considering two

Q150: Your firm is considering an investment that

Q151: If a project's IRR is equal to

Q153: Southeast Compositions,Inc.is considering a project with the

Q154: What is the payback period for a

Q155: An infinite-life replacement chain allows projects of

Q156: If a project is acceptable using the

Q157: If the NPV (Net Present Value)of a