Essay

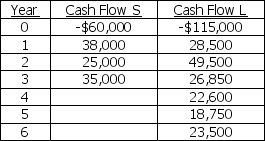

The Meacham Tire Company is considering two mutually exclusive projects with useful lives of 3 and 6 years.The after-tax cash flows for projects S and L are listed below.

The required rate of return on these projects is 14 percent.What decision should be made? As part of your answer,calculate the NPV assuming a replacement chain for Project S,and also calculate the equivalent annual annuity for each project.

Correct Answer:

Verified

Accept Project S because its replacement...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q144: Consider two mutually exclusive projects X and

Q145: A significant disadvantage of the internal rate

Q146: NPV may be calculated on an Excel

Q147: Your firm is considering an investment that

Q148: The profitability index can be helpful when

Q150: Your firm is considering an investment that

Q151: If a project's IRR is equal to

Q152: The Bolster Company is considering two mutually

Q153: Southeast Compositions,Inc.is considering a project with the

Q154: What is the payback period for a